supplies of goods subject to the domestic reverse charge for non-established suppliers.supplies of other services subject to the domestic reverse charge for non-established suppliers, and.‘general’ B2B services rendered between taxpayers established in different MSs,.The EU DRR (e-invoicing and DTBR) would cover: There will be an obligation to issue structured e-invoices and to transmit data from these invoices to the relevant national VAT authorities’ electronic portal, in near real-time (within two working days). The transactions which will be subject to this extended domestic reverse charge will also be part of the e-invoicing and DTBR. The domestic reverse charge would become mandatory for all B2B transactions by non-established suppliers from 1 January 2025 (see more details in a separate article “ViDA – extension of OSS” under “Extended domestic reverse charge”). The proposed EU DRR system (e-invoicing and digital transaction-based reporting (DTBR) would not only apply to all intra-Community supplies and acquisitions of goods and services, but also to all business-to-business (B2B) supplies of goods and services that are taxed in a MS other than that in which the supplier is established. See more details under “Harmonization of the domestic DRRs” below. A domestic DRR introduced in the future cannot require pre-approval of the e-invoices, the existing DRRs are allowed to require pre-clearance until 2028. MSs may oblige specific e-invoicing rules, but they should allow e-invoices that comply with the European standard on e-invoicing (EN 16931) adopted by the Commission Implementing Decision (EU) 2017/187055 and the Directive 2014/55/EU in the context of the B2G e-invoicing (the ‘European standard’). Domestic e-invoicing should allow the European standardįrom 2024, EU Member States (MSs) can impose domestic DRR without a prior approval of the EU.

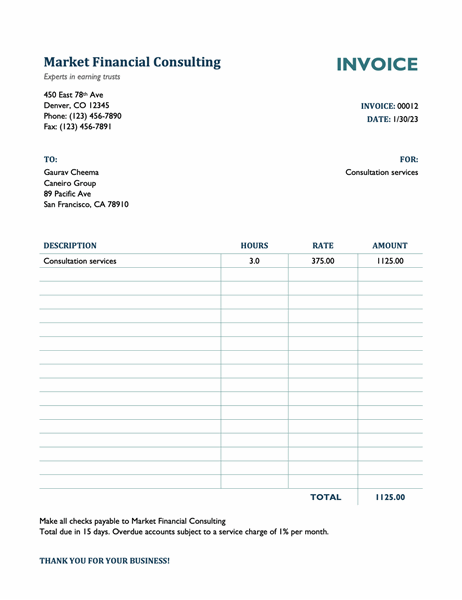

#INVOICING SERVICES PDF#

If a widely used pdf format is not accepted, then all businesses currently issuing invoices in a pdf format and sharing them by an e-mail or a weblink should switch to the new software required to issue structured invoices already by 1 January 2024.

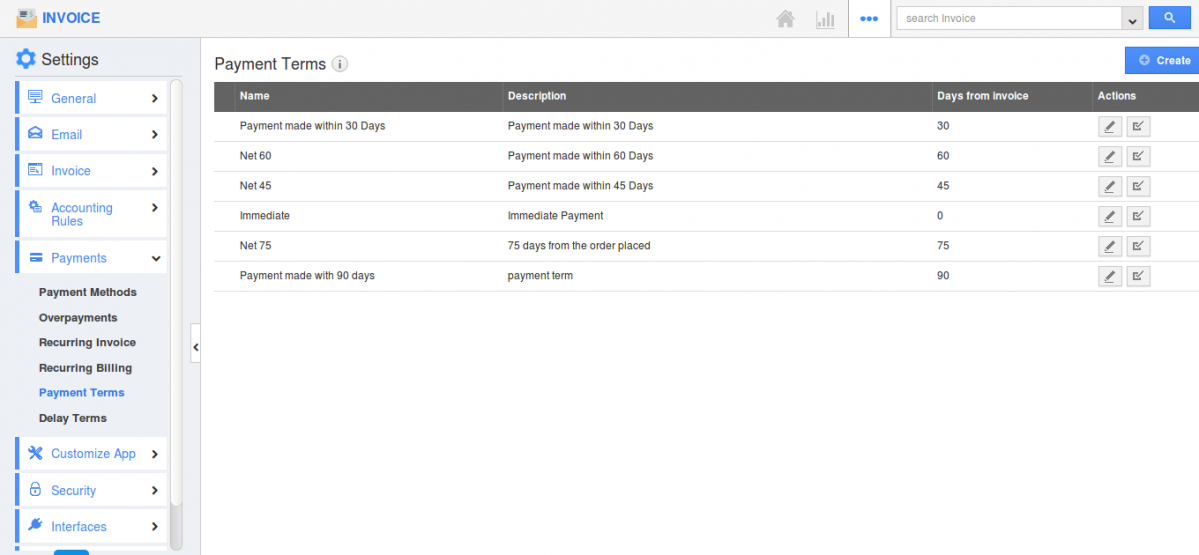

More details about other areas will be described in our other articles which will be published in the following weeks. New VAT rules for platform economy and e-commerceįollowing our preceding general article about VIDA, this article gives a more detailed overview of the proposed changes in the area of the DRR based on e-invoicing and briefly comments on the impact on businesses.To connect your international business partners to the E-Invoicing Service, we recommend the B2B Onboarding Service.The European Commission’s VAT proposals can be divided into three main areas: We will find the right service level for your requirements. Upon request, we provide 24/7 support for you. The changes are made by SEEBURGER in consultation with you. The SEEBURGER Team proactively includes regular modifications of the tax authorities and informs companies about upcoming changes. Secure operation, real time monitoring and maintenance of the required EDI infrastructure

The SEEBURGER team trained for the E-Invoicing Service provides the following services for you:

0 kommentar(er)

0 kommentar(er)